Quantamental Value is an investment research newsletter focused on studying compounders by quantitatively and fundamentally assessing their financial data and analyzing the key value drivers, essentially demystifying the reasons behind them generating above-market returns over long periods of time.

The newsletter attempts to be a rich source of potential opportunities that meet a pre-specified list of proprietarily-developed criteria that prioritizes a track-record of quality, profitability and shareholder value creation.

This newsletter will entail monthly quantamental research on companies and screener results updated monthly.

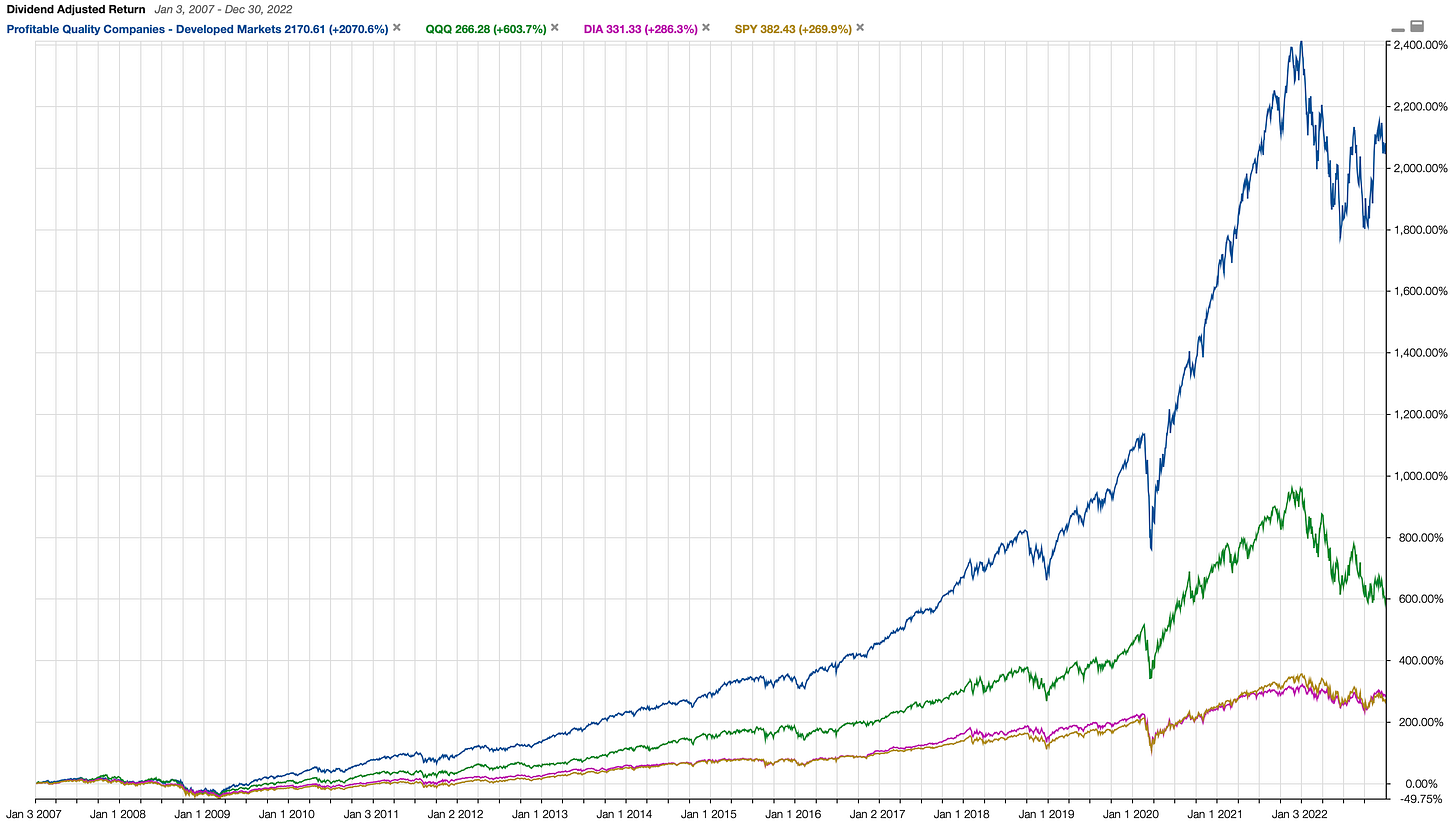

A back-test of our proprietarily-developed screener using StockRover’s powerful tool is shown below (screener result in blue):

“It is far better to own a wonderful company at a fair price than a fair company at a wonderful price.”

Warren Buffett

Subscribe below to take part of this value- and knowledge-accretive journey.

Naif, Author of Quantamental Value