Disclosure: Long Stellantis shares and multiple long-dated call options at $15- $20. This is not an investment recommendation.

On the broad canvas of the investment universe, it's a special joy to stumble upon a company that not only represents genuine deep value characteristics but also stands out in both its absolute and relative financial merits. Such businesses frequently get lost in the market's daily clamor, but they're the very ones that can offer substantial rewards over time.

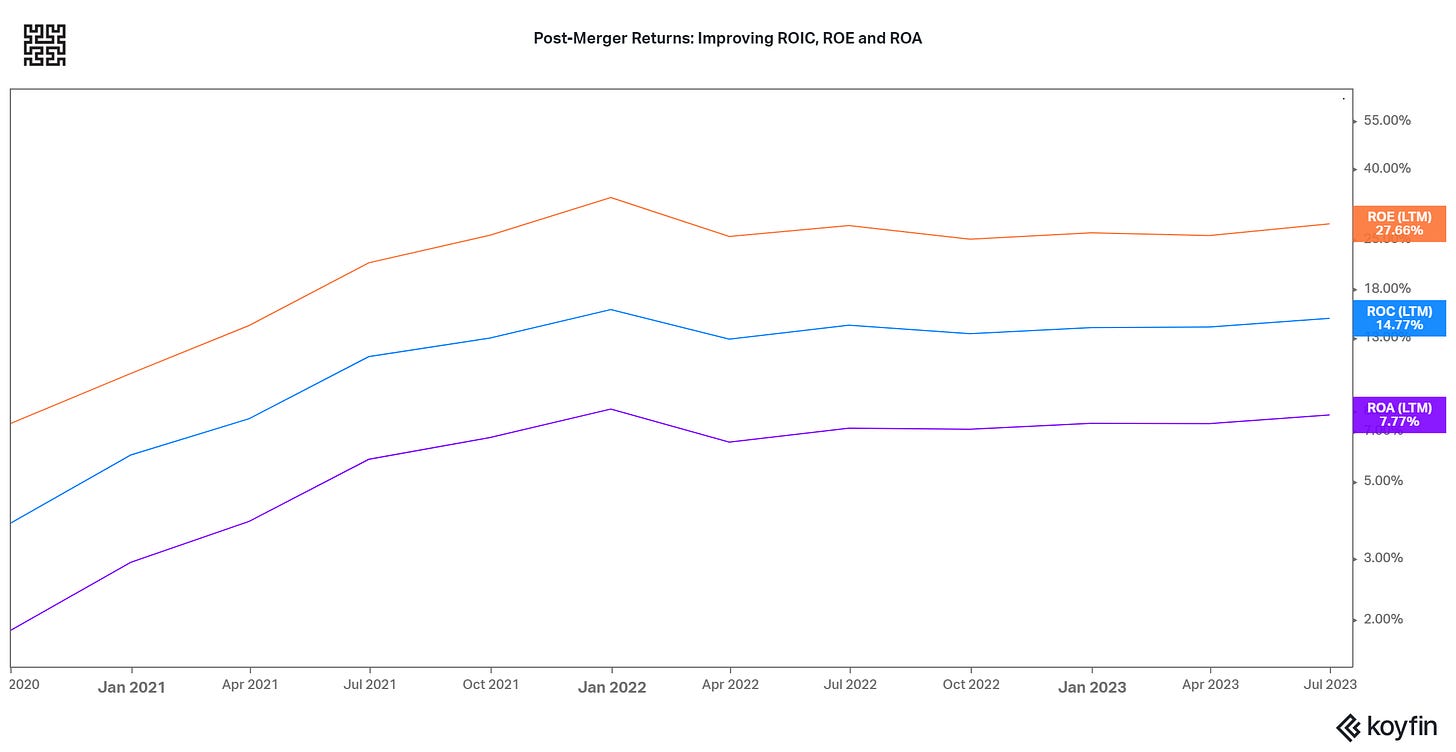

As usual, we find that charts often speak louder and clearer than a multitude of words:

Increasing Revenues and Profits (LTM)

Healthy Balance Sheet, Cash Conversion and a Large Cash Balance (LTM)

Healthy Returns on Investment, Above Cost of Capital and Equity

Improving Fundamentals, Decreasing Valuations

Peer Analysis: EBITDA Margin (#2 among peers)

Peer Analysis: Asset Turnover (#1 among peers)

Peer Analysis: Return on Invested Capital (#1 among peers)

Peer Analysis: Cash Conversion Cycle (#1 among peers)

Peer Analysis: EV/EBITDA (#1 among peers)

All in all, we saw this as an opportunity to invest in the best company in the auto industry at a significant discount to its peers and on an absolute basis. Current valuation serves as significant downside protection with asymmetric upside potential coming from continued profit growth and probable multiple expansion.

STLA Statistics:

LTM FCF yield of 26% (P/FCF of 3.8x)

EV/EBITDA of 1.1x

P/BV of 0.8x

P/Cash of 1.1x

This is not an investment recommendation but merely a summarized version of our rationale for investment.

"Price is what you pay. Value is what you get." - Warren Buffett