We have long wondered how we can achieve similar returns with lower risk against the S&P 500, or higher return with similar risk. It has come to our attention that this can be accomplished through the use of leveraged products with a substantial allocation to cash-equivalents. Hopefully, this is where the combination of risk-averseness and high-returns can meet.

Of course, you can increase or decrease the allocation to equities as desired, which will in turn affect the risk-return relationship.

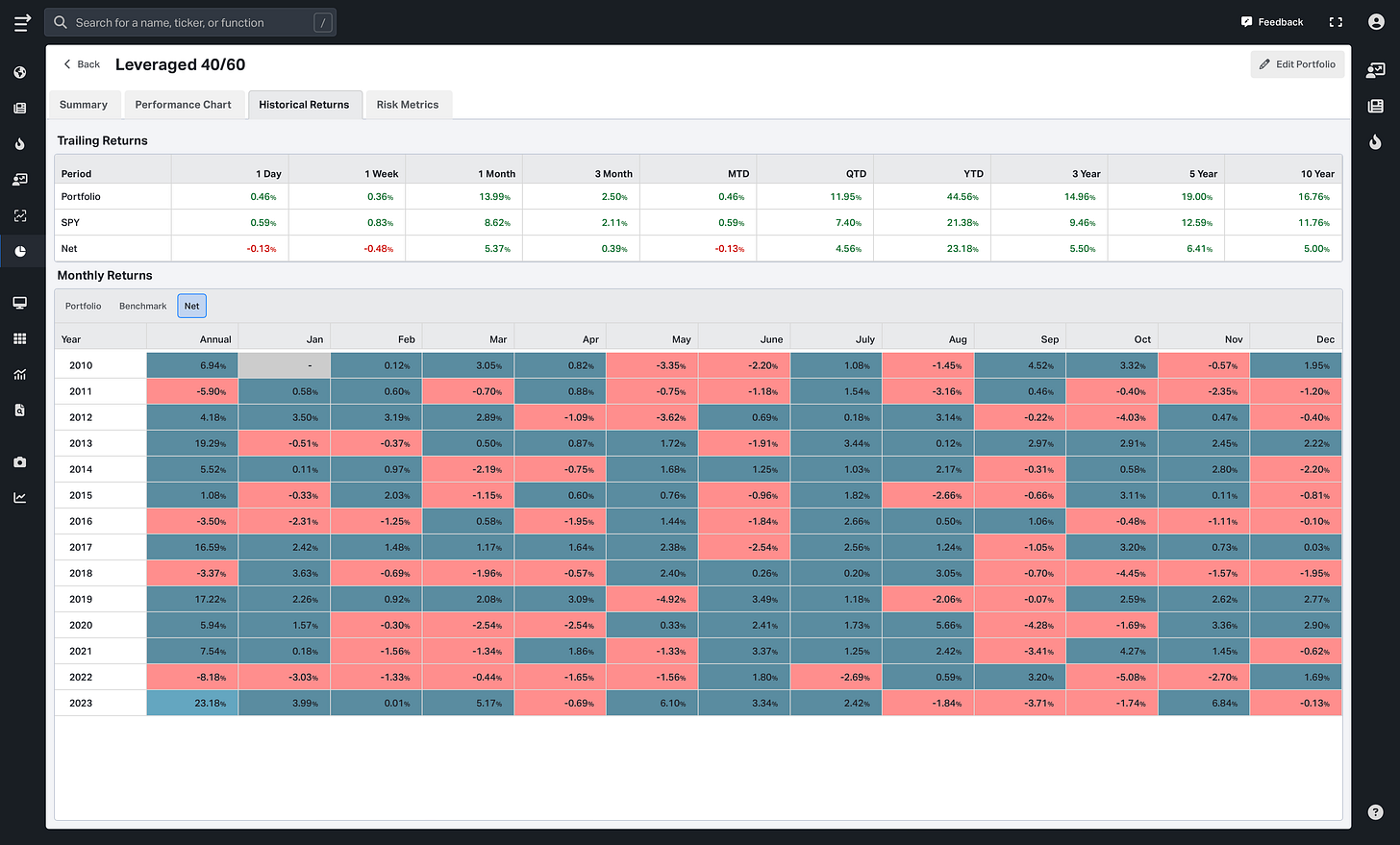

The following has been done using a very intuitive tool called Model Portfolios on Koyfin.

Same Return, Lower Risk

70% allocation to BIL (1-3 Month Treasury Bills)

15% allocation to TQQQ (Triple-Leveraged Nasdaq)

15% allocation to UPRO (Triple-Leveraged S&P 500)

Rebalanced Annually

This has resulted in:

Higher returns;

Beta less than 1.00;

Same downside capture, higher upside capture;

Lower max drawdown; and, most importantly,

Large allocation to cash-equivalents

Point 5 is a very important one, because you can actually use the large cash availability to your advantage by reallocating aggressively when stocks are down.

Higher Return, Similar Risk

60% allocation to BIL

20% allocation to TQQQ

20% allocation to UPRO

Rebalanced Annually

This has resulted in:

Higher returns;

Higher Calmar ratio;

Similar max drawdown;

Better skewness and excess kurtosis; and,

Large allocation to cash-equivalents