Some background on formulas:

Return on Equity (ROE):

Operating Net Income/Equity

Return on Invested Capital (ROIC) - Return on Debt and Equity

Operating Net Income Before Interest/Total Capital

Companies have capital structure decisions to make, and those are specific to their situations. Whether they want to go all-equity, a mix of debt and equity, or heavy on debt really depends on how confident they are about the sustainability of their cash flows.

A company may lure you with its high ROE, but a deeper look into ROIC will uncover how a company is performing relative to its total capital base, not just its equity.

As a shareholder, you will not only be responsible for how the company uses its equity capital, but also for how the company uses (or misuses) leverage and how much they earn (or lose) on top of the cost of debt.

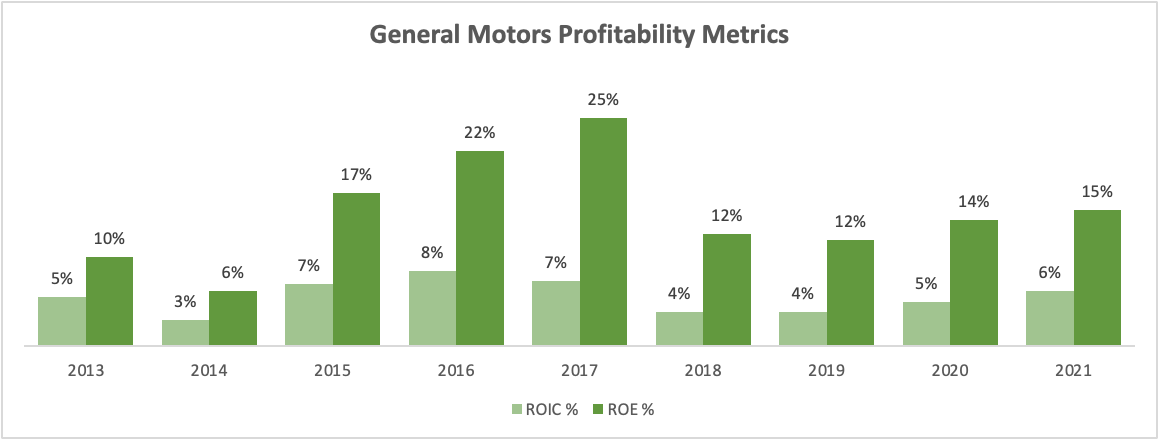

Let us look at a real-life trap - a company that has generated below-market ROIC but relatively good ROE, General Motors:

Since 2013, General Motors has increased its Debt/Capital from 46% to 63%, and you’ll notice the highest ROE registered was when the company’s Debt/Capital was at its peak of 72% in 2017, significantly amplifying a meager 7% return on invested capital.

In 2021, the company earned a ROIC of 6% and a ROE of 15%. What this is essentially saying is that for every dollar - debt and equity - retained, the company has generated 6%, which then translated into 15% for shareholders given the leverage factor.

While ROE may not seem that bad, the enterprise’s 6% ROIC is abysmal. The difference is attributed to leverage, which merely amplified what is a very bad return into what may seem like a good return.

Leverage does not improve returns, it merely amplifies them.

Think about it this way: Why would a company reinvest its cashflows at a 6% return? From an opportunity cost perspective, the company would have created more value had it taken this money and invested it in the market earning 8-9% unlevered; therefore, higher ROIC and even higher ROE.

Key Takeaways:

Ensure a company is earning a ROIC that is higher than market returns

If so, leverage will make what is a good ROIC an even better ROE

“Only when the tide goes out do you learn who has been swimming naked.”

Warren Buffett