Quantamental Value's Approach to Company Selection

The Power of Screening and Data Vizualization

As per TIKR, the total number of listed companies in the US, Canada and Europe is 30,710. Just by adding a filter of 3% revenue CAGR over the past 7 years and an LTM EBITDA Margin of >0%, the universe drops to 4,166, a mere 6.2% pass rate. That is even before removing those that have achieved below market returns on invested capital and some sectors like energy, financials, utilities, materials and real estate.

So, we took that universe and filtered them down further based on our proprietary and methodical screening criteria. After months of analyzing thousands of company data points and financial statements, we carefully selected only those that have demonstrated long-term average and above-average performance.

This has resulted in a universe of about 600 companies, which is about 2% of the investable universe above. By constraining ourselves with just a few hundred companies, we ensure that we remain focused on quality and are investing in companies that have a proven track record of success and are more likely to provide long-term value.

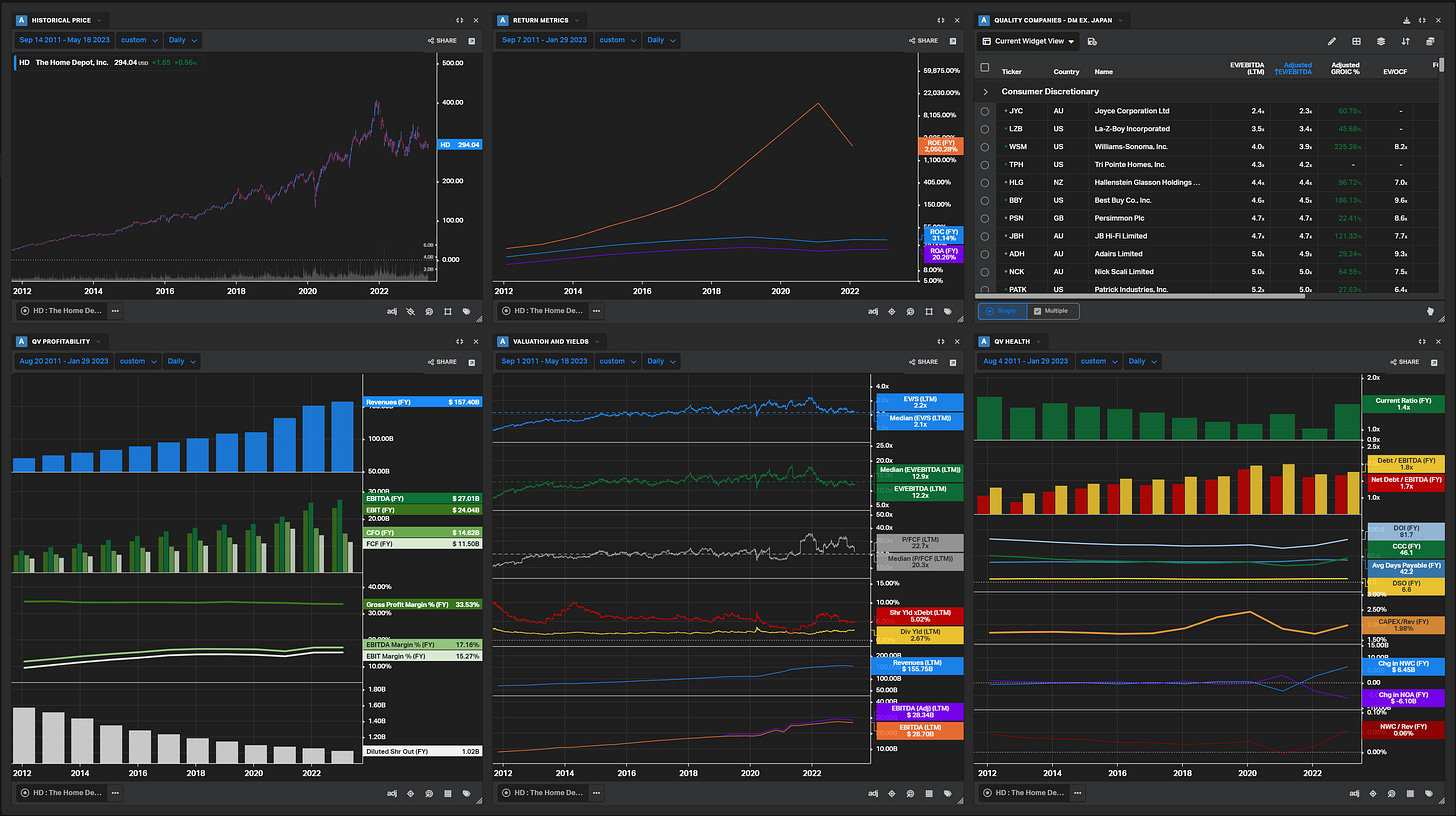

We then created a diversified portfolio (up to 50 names) of above-average revenue growth and ROIC companies at relatively low EV/EBITDA multiples across different sectors and regions. Coincidentally, this has resulted in a portfolio that produces monthly dividend payments, which is a plus.

"I don't look to jump over 7-foot bars: I look around for 1-foot bars that I can step over."

Warren Buffett

Even though we do not believe in EBITDA as a proxy for cashflow, in our case, we made it a proxy for cashflow as we ensured high cash conversion rates for our companies.

We focus on key metrics that create long-term value for shareholders through strong financial position, reinvestment opportunities and capital allocation considerations:

Revenue growth

Profit margin expansion

Reinvestments

Dividends and Share buybacks

Leverage

Net working capital and cash conversion

Balance sheet health

Example: The Home Depot (HD)

"We only need a few good investments in a career to be successful. We don’t need to find all the good investments in the universe. In fact, we don’t need to find very many."

Terry Smith

Disclosure: We are long many companies that pass our screening and filtering criteria, including the above.