Overview

Founded in 1994 in Washington, Amazon is the world’s largest online retailer and technology provider. The company has compounded shareholder value by more than 30% per annum over c. two decades between 2002 and 2021, not only through profitable reinvestment but also through aggressive capital allocation.

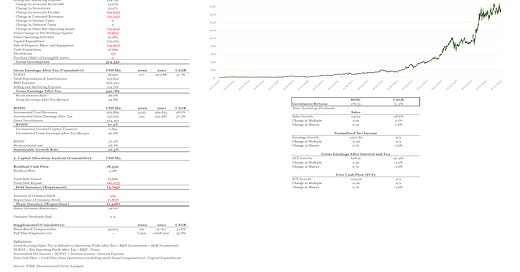

Return on Investment Analysis

Since 2002, AMZN has generated cumulative gross earnings of $542.8 Bn (excluding stock-based compensation), of which the company reinvested a staggering c. 97% ($524.5 Bn) into multiple different opportunities.

Out of the $524.5 Bn gross investments, $205.3 Bn was in the form of Research and Development (Technology and Content), followed by $173.1 Bn in capital expenditures (fulfillment capacity and technology infrastructure) and $124.7 Bn in Selling and Marketing, with minimal and negative net working capital requirements, speaking for a strong cash conversion cycle.

Altogether, these investments, alongside the initial capital in the business of course, have generated $465.9 Bn in incremental revenues, growing revenues at 28.6% CAGR, and $142.6 Bn in incremental gross earnings after tax (37.3% CAGR), for an incremental invested capital turnover of 0.89x at a gross earnings margin of 30.6%; the company has efficiently increased its gross margins as well as operating profit margins over time, enjoying strong scale efficiencies and operating leverage from its fulfillment network.

The resultant gross RONIC is 27.2%; for every dollar invested since 2002, the company has achieved 27.2%.

Capital Allocation Analysis

The Company was able to generate high-double digit growth rates over c. two decades reinvesting 97% of its gross cash flows. Given Jeff Bezos’s relentless focus on future free cash flows, the company did not focus (still does not) on paying dividends or buying back shares. However, given the sizable stock-based compensation program, Amazon has diluted shareholders along the way by increasing share count 36.1% (c. 1.6% dilution per annum). Although dilution did negatively impact existing shareholders, the economic benefit from Amazon’s capital allocation has far exceeded the dilution impact.

Return Attribution

The company has compounded shareholder value at c. 31% per annum over the study period, generating a total of 176.5x return for shareholders. The company created the majority of its return (119.5x) from profitable sales growth, followed by 2.0x from multiple expansion (due to gross margin improvement), offset by 0.7x as a result of dilution. From a gross earnings perspective, it grew by an astonishing 628x, offset by multiple contraction as well as dilution.

Something To Think About

As mentioned in my previous article (found below), free cash flows could be very misleading when a company is aggressively growing and intentionally reinvesting its gross cash flows into R&D, S&M, Capex and net working capital. Hence, looking at gross cash flows and free cash flows in tandem will provide the full picture.

For instance, Amazon could turn off its growth lever whenever (e.g. decides to grow at 5% instead of 20%) and this will result in gigantic free cash flows due to lesser reinvestment which would naturally lead to higher free cash flow margins, but that is of course not the point; Amazon believes there are market opportunities (such as AWS, Prime, etc.) that deserve attention and capital that could potentially lead to even larger profits in the future.

As long as ROIC>WACC, do not penalize a company for not having or having low free cash flows because of its heavy reinvestment rate. Look at its gross earnings to understand the full picture.

Amazon’s Hidden Story

Note: Amazon started providing segment breakdown in 2013

Amazon started channeling capital into Amazon Web Services (AWS), a higher ROA and higher margin business

Amazon continues to build fulfillment capacity and invest heavily in warehouses/facilities on an annual basis, leading to artificially large depreciation figures; hence, the spread between EBIT and EBITDA is currently large and should decrease and converge as the company eases growth investments.

Amazon continues to invest heavily in AWS, Prime and other products/services in its R&D pipeline, which hopefully should bear fruit in the future.

Story In Pictures

Source: Quantamental Value Analysis, TIKR

“Today people who hold cash equivalents feel comfortable. They shouldn't. They have opted for a terrible long-term asset, one that pays virtually nothing and is certain to depreciate in value”

Warren Buffett